All Categories

Featured

Table of Contents

The requirements also advertise advancement and progression with added investment. In spite of being approved, all investors still need to do their due diligence during the process of investing. 1031 Crowdfunding is a leading realty investment system for alternative financial investment vehicles primarily offered to certified financiers. Approved investors can access our option of vetted investment possibilities.

With over $1.1 billion in securities offered, the administration team at 1031 Crowdfunding has experience with a wide variety of investment frameworks. To access our full offerings, register for a financier account.

Accredited's workplace culture has actually commonly been We think in leaning in to sustain enhancing the lives of our coworkers similarly we ask each various other to lean in to passionately support improving the lives of our clients and area. We supply by supplying means for our team to remainder and re-energize.

Expert Accredited Crowdfunding Near Me – Miami

We additionally provide to Our wonderfully selected building includes a physical fitness space, Relax & Relaxation areas, and modern technology developed to sustain flexible workspaces. Our finest ideas originate from teaming up with each other, whether in the office or functioning from another location. Our positive investments in modern technology have actually enabled us to develop an allowing team to add any place they are.

If you have a passion and feel you would certainly be an excellent fit, we would enjoy to attach. Please make inquiries at.

Affordable Investment Opportunities For Accredited Investors – Miami

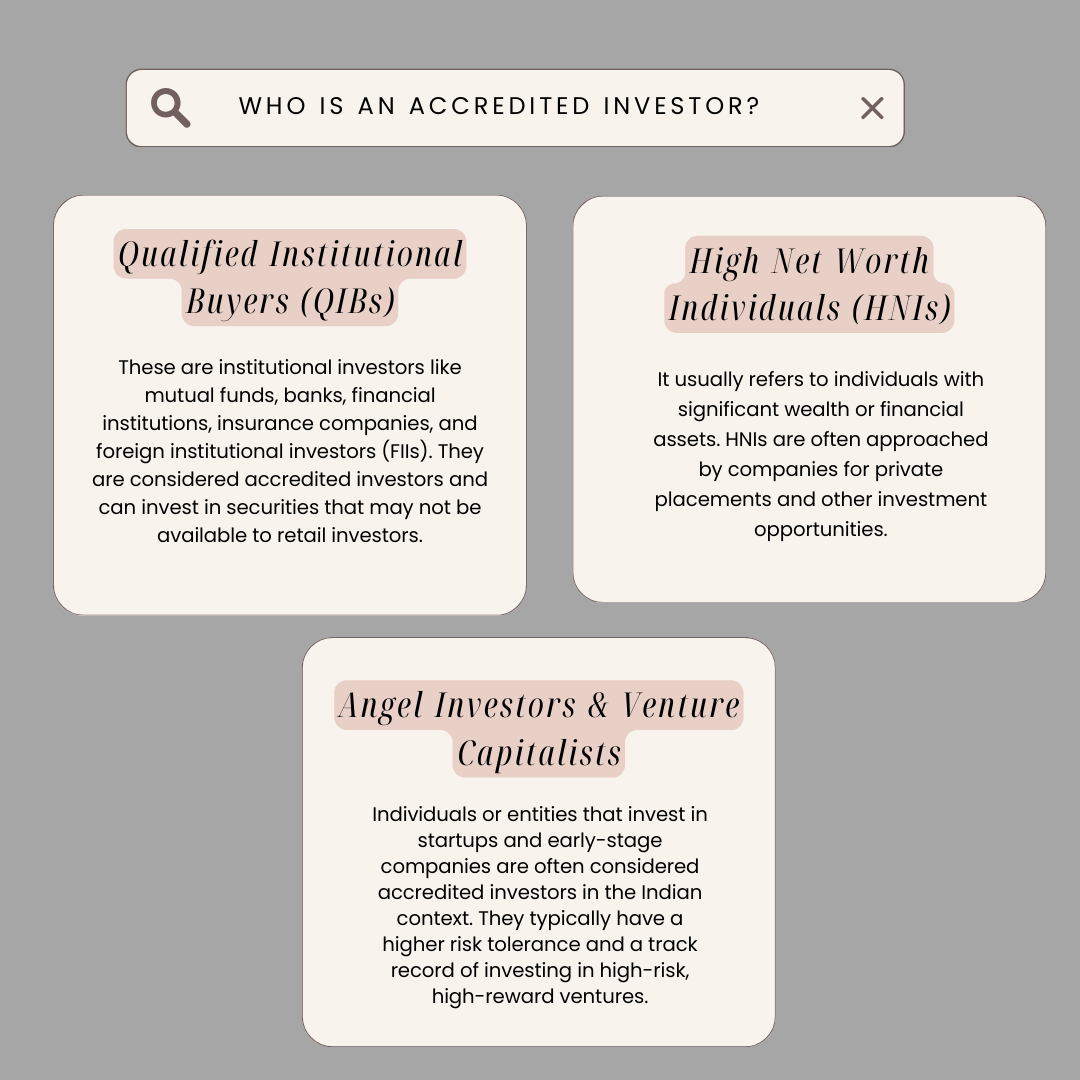

Recognized financiers (often called certified financiers) have access to financial investments that aren't offered to the public. These financial investments might be hedge funds, difficult cash lendings, convertible investments, or any type of various other safety and security that isn't signed up with the economic authorities. In this article, we're mosting likely to concentrate particularly on real estate investment alternatives for recognized capitalists.

This is every little thing you need to find out about actual estate spending for approved financiers (506c investmentbest investments for accredited investors). While any individual can purchase well-regulated securities like supplies, bonds, treasury notes, common funds, etc, the SEC is concerned regarding typical financiers entering investments past their methods or understanding. So, rather than permitting any individual to purchase anything, the SEC developed a recognized financier standard.

It's important to keep in mind that SEC guidelines for certified financiers are developed to safeguard financiers. Without oversight from financial regulatory authorities, the SEC merely can't evaluate the risk and benefit of these investments, so they can't supply info to enlighten the average capitalist.

The concept is that financiers who gain adequate revenue or have adequate riches are able to absorb the threat far better than capitalists with lower income or less riches. As a recognized capitalist, you are anticipated to complete your own due persistance before including any possession to your investment portfolio. As long as you meet one of the complying with 4 demands, you certify as a certified financier: You have made $200,000 or more in gross earnings as an individual, yearly, for the previous two years.

Client-Focused Real Estate Crowdfunding Accredited Investors

You and your partner have had a mixed gross income of $300,000 or more, each year, for the past 2 years (secure investments for accredited investors). And you expect this degree of income to continue.

Or all equity owners in the service certify as accredited financiers. Being a certified investor opens up doors to financial investment chances that you can't access or else. Once you're recognized, you have the choice to buy unregulated protections, which consists of some impressive financial investment opportunities in the property market. There is a vast array of realty investing techniques available to financiers that do not presently satisfy the SEC's needs for accreditation.

Client-Focused Tax-advantaged Investments For Accredited Investors

Becoming an accredited investor is merely an issue of proving that you meet the SEC's requirements. To confirm your income, you can offer paperwork like: Earnings tax returns for the previous 2 years, Pay stubs for the previous two years, or W2s for the previous two years. To confirm your total assets, you can supply your account declarations for all your assets and obligations, including: Cost savings and inspecting accounts, Financial investment accounts, Impressive car loans, And actual estate holdings.

You can have your lawyer or certified public accountant draft a confirmation letter, confirming that they have actually evaluated your financials which you meet the demands for a certified financier. However it may be a lot more cost-effective to make use of a service particularly made to validate recognized investor standings, such as EarlyIQ or .

Top Real Estate Accredited Investors Near Me (Miami 33101 FL)

, your certified capitalist application will certainly be refined with VerifyInvestor.com at no expense to you. The terms angel capitalists, innovative capitalists, and certified investors are often used interchangeably, however there are refined differences.

Normally, anybody who is certified is thought to be an innovative capitalist. Individuals and company entities who keep high revenues or considerable riches are presumed to have reasonable knowledge of financing, qualifying as sophisticated. accredited investment platforms. Yes, worldwide financiers can end up being certified by American monetary standards. The income/net worth requirements stay the exact same for international financiers.

Below are the most effective investment opportunities for recognized financiers in property. is when investors pool their funds to buy or renovate a building, then share in the earnings. Crowdfunding has actually turned into one of one of the most preferred techniques of buying realty online since the JOBS Act of 2012 permitted crowdfunding systems to supply shares of property tasks to the general public.

Some crowdfunded actual estate financial investments don't require certification, however the projects with the best potential incentives are generally scheduled for accredited financiers. The difference in between projects that accept non-accredited capitalists and those that only accept recognized investors commonly boils down to the minimum financial investment quantity. The SEC presently restricts non-accredited financiers, who earn less than $107,000 per year) to $2,200 (or 5% of your annual earnings or web well worth, whichever is much less, if that amount is greater than $2,200) of financial investment funding each year.

Latest Posts

Tax Foreclosure Properties Services

Tax Lien Delinquent

Foreclosure Property Taxes Owed